GnuCash is easy enough to use that you do not need to have a complete understanding of accounting

principles to find it useful. However, you will find that some basic accounting knowledge will

prove to be invaluable as GnuCash was designed using these principles as a template. It is

highly recommended that you understand this section of the guide before proceeding.

Basic accounting rules group all finance related things into 5 fundamental types of “accounts”. That is, everything that accounting deals with can be placed into one of these 5 accounts:

Account types

- Assets

Things you own

- Liabilities

Things you owe

- Equity

Overall net worth

- Income

Increases the value of your accounts

- Expenses

Decreases the value of your accounts

It is clear that it is possible to categorize your financial world into these 5 groups. For example, the cash in your bank account is an asset, your mortgage is a liability, your paycheck is income, and the cost of dinner last night is an expense.

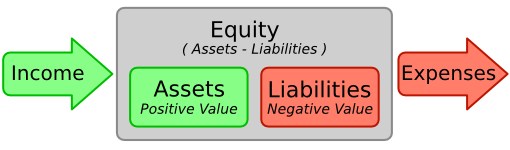

With the 5 basic accounts defined, what is the relationship between them? How does one type of account affect the others? Firstly, equity is defined by assets and liability. That is, your net worth is calculated by subtracting your liabilities from your assets:

Furthermore, you can increase your equity through income, and decrease equity through expenses. This makes sense of course, when you receive a paycheck you become “richer” and when you pay for dinner you become “poorer”. This is expressed mathematically in what is known as the Accounting Equation:

This equation must always be balanced, a condition that can only be satisfied if you enter values to multiple accounts. For example: if you receive money in the form of income you must see an equal increase in your assets. As another example, you could have an increase in assets if you have a parallel increase in liabilities.

The use of debits and credits in accounting and their effect on accounts of different types is often confusing when first encountered in accounting. The accounting equation introduced above is the key to understanding which accounts types are debited or credited and when. First of all we need to rearrange the expanded form a little bit with Assets on the left hand side of the equal sign and transposing any account type with a negative sign to the other side to obtain:

With the accounting equation in this form, the accounts on the left hand side of the equal sign are known as debit balance accounts in accounting practice, that is the normal positive balance for these accounts is increased by debit entries to accounts of these types. Conversely credit entries to accounts of these types will decrease the balance of accounts of these types.

Similarly, the account types on the right hand side of the equal sign are known as credit balance accounts, that is the normal positive balance for these account types is increased by credit entries to the accounts of these types. Again debit entries to accounts of these types will reduce the balance in the account.

Table 2.1. Summary of effect of debits (Dr) and credits (Cr) on the balance of accounts of the 5 account types

| Account Type | Effect on Account Balance | |

|---|---|---|

| Debit (Dr) | Credit (Cr) | |

| Assets | Increase | Decrease |

| Expenses | ||

| Liabilities | Decrease | Increase |

| Equity | ||

| Income | ||

The accounting equation is the very heart of a double entry accounting

system. For every change in value of one account in the Accounting Equation,

there must be a balancing change in another. This concept is known as the

Principle of Balance, and is of fundamental importance for

understanding GnuCash and other double entry accounting systems. When you work with GnuCash, you

will always be concerned with at least 2 accounts, to keep the accounting equation balanced.

Balancing changes (or transfers of money) among accounts are done by debiting one account and simultaneously crediting another. Accounting debits and credits do not mean “decrease” and “increase”. Debits and credits each increase certain types of accounts and decrease others as described in the previous section. In asset and expense accounts, debits increase the balance and credits decrease the balance. In liability, equity and income accounts, credits increase the balance and debits decrease the balance.

In traditional double-entry accounting, the left column in the register is used for debits, while

the right column is used for credits. Accountants record increases in asset and expense

accounts on the debit (left) side, and they record increases in liability, income, and

equity accounts on the credit (right) side. GnuCash follows this convention in the register.

| Note |

|---|---|

This accounting terminology can be confusing to new users, which is why | |

| Warning |

|---|---|

Common use of the words debit and credit does not match how accountants use these words. In common use, credit generally has positive associations; in accounting, credit means affecting the right column of the ledger sheet of an account. This is associated with a decrease in asset and expense, but an increase of income, liability and equity accounts. For more details see https://en.wikipedia.org/wiki/Debits_and_credits. | |